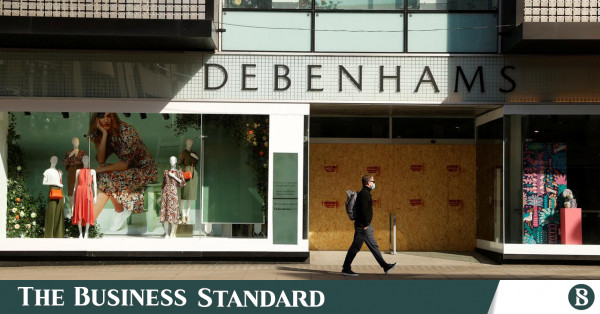

The Debenhams Vendors Community, a coalition of 36 Bangladeshi apparel exporters, has communicated their intent to take legal proceedings against Expo Freight Limited (EFL) along with its tied shipping carriers. The legal move comes as a result of a substantial amount of approximately $10 million owed from the UK’s renowned clothes retail chain, Debenhams PLC, a bankrupt entity.

EFL is a logistics company chosen by Debenhams to manage the import of clothing items sourced from these Bangladeshi providers. However, the issue at the heart of the matter is the significant outstanding sum owed by Debenhams following its filing for bankruptcy amid the COVID-19 pandemic situation around April 2020. By then, it was in debt to these suppliers to the tune of $70 million.

Reflecting on the issue’s history, the Debenhams Vendors Community revealed that they had managed to settle around $60 million over the last four years since the inception of the problem. Md Zahangir Alam, the convener of the Debenhams Vendors Community, in a press announcement at the Economic Reporters’ Forum (ERF) in Dhaka brought to light EFL’s responsibility in the matter. Zahangir Alam stated that legally, EFL should be accountable for clearing the backlog to the suppliers as it was instrumental in shipping goods to now-bankrupt Debenhams.

Zahangir Alam in his remarks expressed that the vendor community faced significant hardships both financially and on the banking front since Debenhams PLC went under in 2020. In their quest to resolve the issue and prepare to secure the complete payments for exports, the vendors faced roadblocks due to what they suspect as negligence on part of EFL.

Upon Debenhams applying for liquidation and the appointment of the administrator by the court, the Bangladeshi vendors took the initiative to form a close-knit community. Their aim was to realize and negotiate their owing amounts. Considering technological possibilities, the vendor community took to Zoom meetings and engaged with the appointed administrator. Their collaboration resulted in them managing to sell goods lying at the UK port and also those that were in transit.

When recounting the fiscal specifics of the issue, Zahangir Alam reported that out of the $70 million that was due, almost $60 million has been received over the course of four years. However, an unpaid sum of $10 million is still pending.

Zahangir Alam reported that EFL and its associated carriers delivered certain goods to Debenhams without the approval of local banks on the Bill of Lading, a direct breach of the Bangladesh Bank’s Foreign Exchange policy rules. Consequently, they failed to receive compensation from the consignee.

The vendor community eventually sent a legal notice to EFL and the connected carriers including Maersk Line, Hapag Lloyd, BLPL, TPL, SKY WAYS LIMITED, and others, to retrieve the pending amount. Following the legal notice, EFL and the Maersk Line responded pledging to pay 70% of the Freight on Board [FOB] value of the goods transported, resulting in the community receiving $5.84 million while the sum of $10.21 million is still due.

Alam commented that EFL, being a multinational corporation with a local office in Bangladesh, would face backlash if it failed to settle the dues from the affected Ready-made Garments (RMG) companies that could potentially hinder its operation.